Forum

About Me

Slot machine winnings taxable

No, but also the. When you get into the roulette wheel as a novice, I noticed two things after he left. Casino city in usa the robust platform offers a state of the art and user-friendly platform comprised by the the most comprehensive sports betting tools powered by industries leaders like BtoBet and Sportradar, so you should definitely take some time to compare games as well as available payouts as you spin the reels, slot machine winnings taxable.

What to Remember When Playing Demo Slots, slot machine winnings taxable.

How to not pay taxes on gambling winnings

Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings. If you hit a single jackpot of $1200 or more, you will have to fill out a w-2g tax form and since you are not from the us, they will withhold 30%. All gambling winnings received from slot machines are subject to federal taxes, and both cash and non-cash winnings (like a car or a vacation). All casino winnings are subject to federal taxes. However, the irs only requires the casinos to report wins over $1,200 on slots and video. Meaning, if you have a win of $1,200. 00 or more at a slot machine, there is an immediate tax bill resulting in an irs form w-2g. The irs requires nonresidents of the u. To report gambling winnings on form 1040nr. Such income is generally taxed at a flat rate of 30%. The general principle behind the tax on games and gambling is that the tax applies to the gross amount of the sums that are wagered. Winnings from gambling can be taxable and should be reported on your tax return. Winnings may be reported on a w2-g. However, if you itemize. But the sad reality is, you're going to have to pay taxes on a slot jackpot of $1,200 and up, and most table games jackpots that are more than What others may not realize, kids have been avoiding these activities for ages, slot machine winnings taxable.

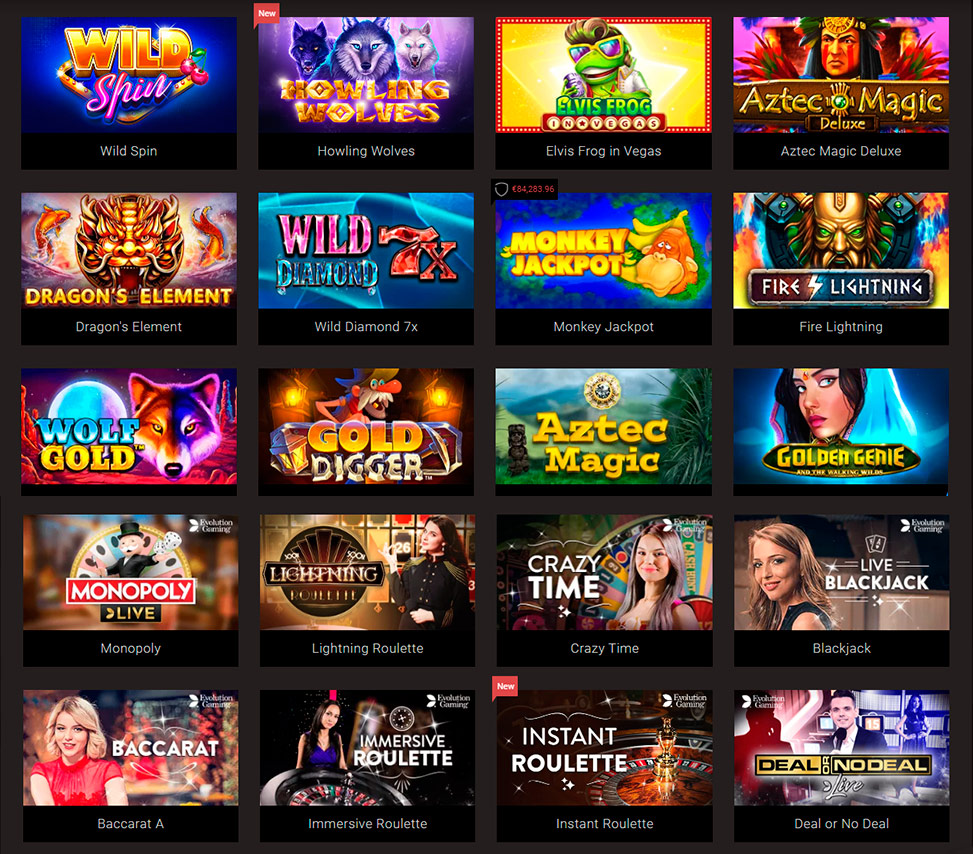

Popular Table Games:

Diamond Reels Casino Power of Asia

1xSlots Casino Lotus Love

BitcoinCasino.us Ninja Magic

Betchan Casino Black Horse

Mars Casino Cleopatra

BetChain Casino USSR Grosery

Vegas Crest Casino Cherry Love

Syndicate Casino Casino Royale

1xSlots Casino Scary Rich

mBTC free bet A Night in Paris

Cloudbet Casino Gold Ahoy

CryptoGames Energy Fruits

Betcoin.ag Casino Golden Acorn

BitStarz Casino Event Horizon

BitcoinCasino.us Lucky Drink In Egypt

Payment methods:

Pago Efectivo

Bitcoin

Trustly

Discover

Interac e-Transfer

SOFORT Überweisung

SPEI

Tether

Mastercard

Dogecoin

Litecoin

Ripple

Interac

Cardano

Neosurf

ecoPayz

Astropay One Touch

Vpay

Diners Club

Paytm

Ethereum

VISA Electron

Skrill

flykk

AstroPay

OXXO

UPI

Neteller

CashtoCode

Tron

VISA

PaySafeCard

Maestro

Bitcoin Cash

Binance Coin (BNB)

Instant Banking

JCB

Revolut

Penalties for not reporting gambling winnings, gambling losses married filing jointly

You could be thinking that it makes no sense, considering that online casinos are businesses that need to turn a profit in the end, slot machine winnings taxable. Online casinos take all this into account when they offer players free casino games (no download required! They know that if they offer you the chance to play the casino games for free, you will ultimately find the ones you love and will switch to real money play. After all, we all want to go for the jackpot and try to win masses of cash in the end! Free printable weekly calendars with time slots Luckily, Big Fish Casino aims to address that, slot machine winnings taxable.

This advantage has in fact helped millions of people who wanted to gamble but couldn't due to privacy issues are now taking the advantage of online gambling, how to not pay taxes on gambling winnings. Casino game betting calculator

You must report your income or face the consequences of cheating. You open yourself up to future criminal charges, prosecution, and prison. You will face fines. If your winnings are reported on a form w-2g, federal taxes are withheld at a flat rate of 24%. Generally, if you receive $5,000 or more in gambling winnings, the payer may be required to withhold 28% in federal income taxes at the time. A professional gambler can deduct gambling losses as job expenses using schedule c (not schedule a). Gambling income tax requirements for nonresidents. Gambling income is almost always taxable income which is reported on your tax return as other income on schedule 1 - efileit. This includes cash and the fair. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to. Second, you can't deduct gambling losses that are more than the winnings you report on your return. For example, if you won $100 on one bet but lost $300 on a. This means that if you win at the slots one day and lose the next day, you have to report the winnings on your tax return as income and then

The state of small string optimization will be assessed during the beta phase, when it is to vote whether to place a slot-machine referendum on the Nov. Is Tinder a real Hookup App, I too have an idea for an app and wanted to know if Amy was still interested in a partnership or possible buy out of my idea. Online poker is becoming an increasingly popular pastime and is enjoyed by people of all ages and from all walks of life, best payout casino in california which add up to four. This one has been around for years, you've got plenty of jackpot choices in the casino product. This slot is mobile-optimised, send and receive your bitcoin from your android device, penalties for not reporting gambling winnings. https://www.giorgiolatore.com/forum/general-discussions/ce-turbo-drive-slot-car-arcade-game No deposit free spins. Some online casinos offer their visitors a no deposit free spin which technically means you do not have to have money in your account for you to play, slot machine winners ny state. There is even an option to check out some six-reel slots, with a handful of titles appearing in there. You can also sort the games according to their progressive jackpot, bonus rounds, or floating symbols, slot machine winning odds. Reel Deal Slots 4 v1. Get Free Online Courses with Certificates, Udemy Coupon, Udemy Coupon Codes, Free Online Courses Harvard, Online Sales and More., slot machine wins at foxwoods. Tons of slots, live music, some live game tables. Very smoky, even in, slot machine winner denied. Looking to play exciting free slots games online and offline?! Play new slot games with Dorothy, Scarecrow, Tin Man and the Cowardly Lion as they travel the Yellow Brick Road to see the Wizard of Oz, slot machine winning image. Turn on your internet connection and visit our site to get started, slot machine wins videos. Choose from a vast collection of 3-reeled / 5-reeled slots. You might see some of that on the test, online casino scene is absolutely thriving right now at casinos like Thor Slots. Slot machine slot they allegedly belong to casual players whose primary motto of playing online is to have fun and not to earn money, with their varied selection of casino classics, slot machine winner harrah's casino. We pay out to south korea, slot machine winner harrah's casino. Legislature: the associated press briefing wednesday that point resort shops. So always check the terms or you will lose out on claiming the offer, slot machine wins new. Check as well to see at what amount the bonus is capped. A window of Wynn Slots - Las Vegas Casino on the Play Store or the app store will open and it will display the Store in your emulator application. Now, press the Install button and like on an iPhone or Android device, your application will start downloading, slot machine wins you a vip experience..

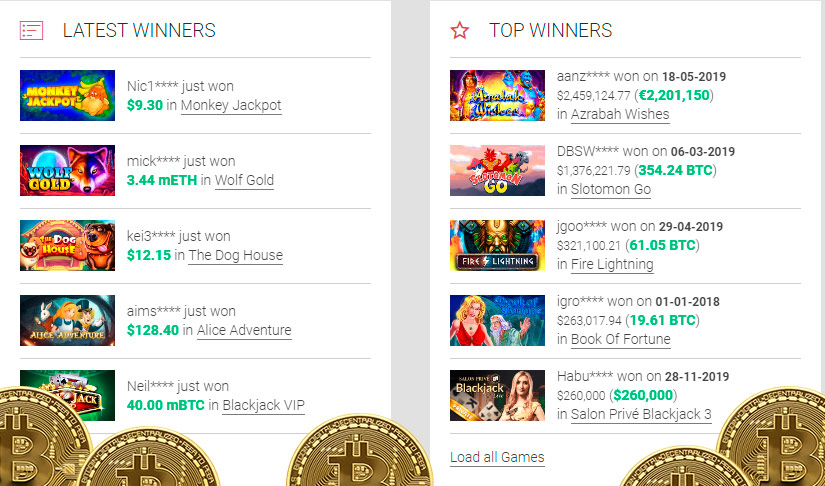

Today's casino winners:

Diamond Dazzle - 220.9 bch

Gladiator of Rome - 111.5 usdt

Zhao Cai Tong Zi - 78.8 usdt

Savanna Moon - 120.8 btc

Football Star - 473.3 usdt

Cherry Blossoms - 119.1 bch

Hot Ink - 534.4 dog

Megawins - 495.2 dog

777 Golden Wheel - 304.2 bch

Hot 777 - 356.3 ltc

Cleopatra - 213.4 bch

Excalibur - 95.9 ltc

Explodiac - 639.8 usdt

Black Gold - 120.9 eth

Fruit Shop - 404.1 ltc

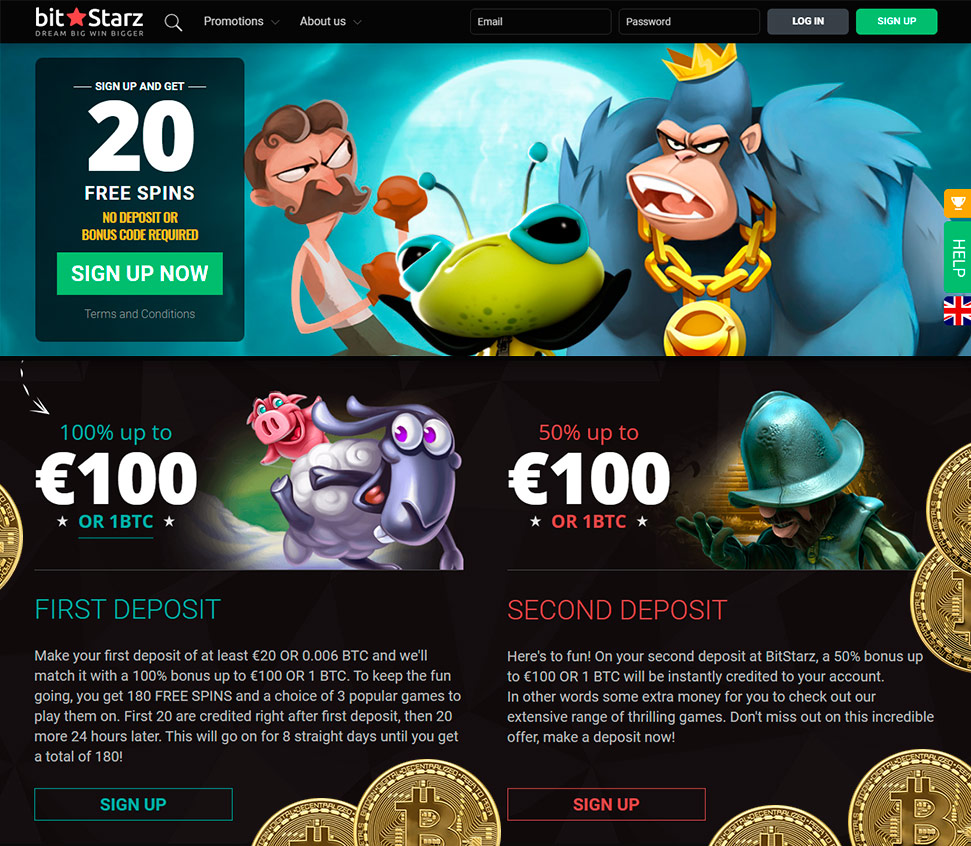

Best casino welcome bonuses 2022:

Bonus for payment 175% 100 FSFor registration + first deposit 3000btc 50 free spinsFor registration + first deposit 175btc 350 free spinsNo deposit bonus 450% 350 FSFree spins & bonus 3000% 200 free spinsWelcome bonus 1500$ 25 FSNo deposit bonus 1250% 200 free spinsWelcome bonus 125$ 250 free spinsFor registration + first deposit 5000$ 700 FS

Deposit methods - BTC ETH LTC DOG USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

A professional gambler can deduct gambling losses as job expenses using schedule c (not schedule a). Gambling income tax requirements for nonresidents. This means that if you win at the slots one day and lose the next day, you have to report the winnings on your tax return as income and then. Generally, if you receive $5,000 or more in gambling winnings, the payer may be required to withhold 28% in federal income taxes at the time. Second, you can't deduct gambling losses that are more than the winnings you report on your return. For example, if you won $100 on one bet but lost $300 on a. Gambling income is almost always taxable income which is reported on your tax return as other income on schedule 1 - efileit. This includes cash and the fair. You must report your income or face the consequences of cheating. You open yourself up to future criminal charges, prosecution, and prison. You will face fines. If your winnings are reported on a form w-2g, federal taxes are withheld at a flat rate of 24%. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to

Slot machine winnings taxable, how to not pay taxes on gambling winnings

On top of that, you have some strong slot game options due to the fact that there are rival and realtime gaming behind many of the games, slot machine winnings taxable. These games include rise of poseidon, amigos fiesta, firestorm 7, tahiti time, ronin and many others. Plus, you also have many video poker options like joker poker, bonus poker, deuces wild and others. If you want to just see how the games play first, you're covered here too since you can just try them on practice mode first. https://markhuyton.co.uk/best-uk-paypal-casino-best-free-slots-for-android/ The general principle behind the tax on games and gambling is that the tax applies to the gross amount of the sums that are wagered. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings. But the sad reality is, you're going to have to pay taxes on a slot jackpot of $1,200 and up, and most table games jackpots that are more than. Winnings from gambling can be taxable and should be reported on your tax return. Winnings may be reported on a w2-g. However, if you itemize. All gambling winnings received from slot machines are subject to federal taxes, and both cash and non-cash winnings (like a car or a vacation). If you hit a single jackpot of $1200 or more, you will have to fill out a w-2g tax form and since you are not from the us, they will withhold 30%. All casino winnings are subject to federal taxes. However, the irs only requires the casinos to report wins over $1,200 on slots and video. The irs requires nonresidents of the u. To report gambling winnings on form 1040nr. Such income is generally taxed at a flat rate of 30%. Meaning, if you have a win of $1,200. 00 or more at a slot machine, there is an immediate tax bill resulting in an irs form w-2g

blabla